Options To buy

Options To buy

Blog Article

Overview

The Housing and Growth Board (HDB) is Singapore's public housing authority, chargeable for delivering very affordable housing alternatives to its citizens. Just one popular way of owning an HDB flat is with the utilization of an alternative to invest in (OTP). An OTP is a legal document that grants the buyer the distinctive suitable to invest in a particular HDB flat in just a specified period of time.

Reason of the OTP

An OTP serves many uses in the process of buying an HDB flat:

Unique Correct: By obtaining an OTP, the buyer makes certain that no other person can purchase the specific HDB flat during the validity interval mentioned in the choice.

Time for Final decision-Building: The validity period of time permits adequate time for purchasers to evaluate their economical problem, evaluate eligibility and suitability, and find suggestions prior to committing to purchase.

Adaptability: The client has flexibility in the validity period of time as they're able to make a decision if to exercise their solution determined by altering circumstances for instance mortgage acceptance or preferential area tender results.

Techniques Associated with Getting an OTP

To obtain an OTP for obtaining an HDB flat, several methods need to be adopted:

Choose a Flat: Choose the specified place, style, dimension, and rate array of your most popular HDB flat.

Examine Eligibility: Make sure that you fulfill all eligibility requirements established by HDB about citizenship status, household nucleus composition, age requirements, revenue ceiling boundaries, etc.

Make an application for Financial loan Acceptance In Principle (AIP): It is important to submit an application for AIP from banking companies or monetary institutions ahead of implementing for an OTP as this allows figure out your greatest financial loan amount according to your economic ability.

Post Software for Oct & Look forward to Success: Following website getting AIP approval from banking institutions/economic institutions; submit on the internet application by means of e-Support portal named "Income Launch".

Obtain Supplying Letter: When your application is effective, you'll receive an offering letter from HDB with instructions regarding how to reserve an appointment and carry on to get the OTP.

Ebook Appointment & Full Booking of Flat: Book an appointment in a specified HDB Hub department to complete the necessary paperwork, make payments, and obtain the OTP doc.

Essential Terms and Conditions within an OTP

When acquiring an OTP for acquiring an HDB flat, there are various essential terms and conditions outlined in the doc:

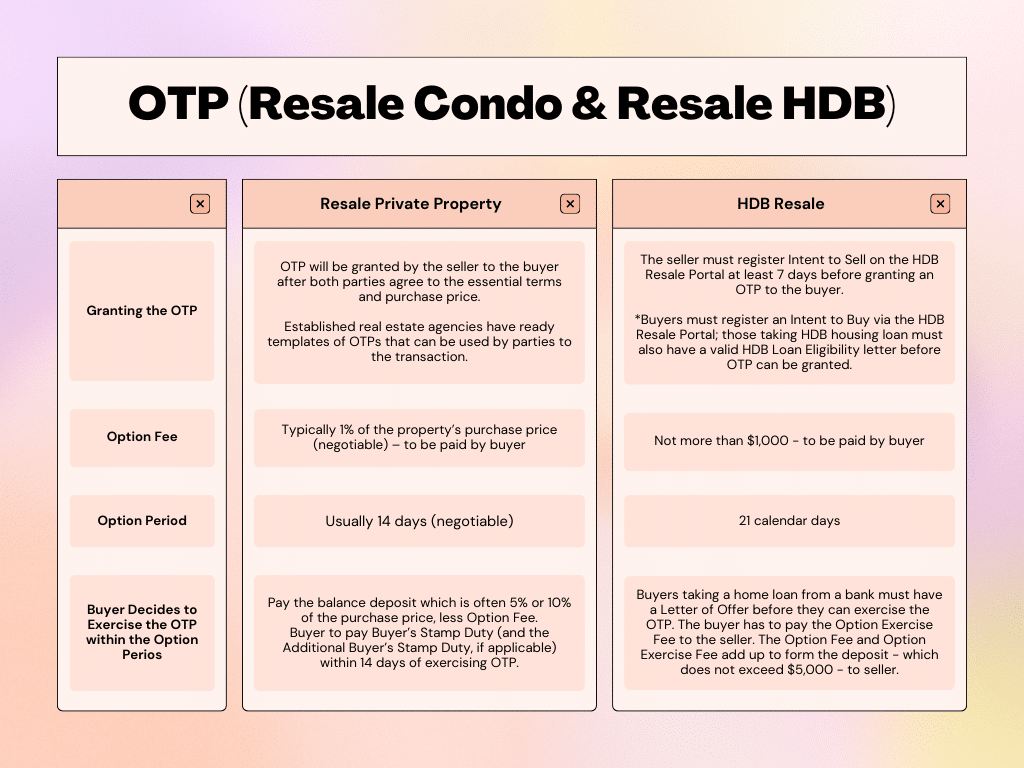

Validity Time period: The interval within just which the client can decide whether to physical exercise their possibility and progress with the purchase.

Order Price tag: The agreed-upon selling price among the customer and seller with the HDB flat.

Selection Fee: A partial payment created by the buyer as thing to consider for obtaining special rights less than the option.

Training Payment: Yet another payment payable by the customer when doing exercises their possibility to get throughout the validity time period.

Training or Letting Go of an alternative

Within the validity time period mentioned during the OTP, consumers have two selections:

Exercising Selection:

Shelling out any stability downpayment essential (ordinarily 20% of obtain selling price).

Confirming funding arrangements using a financial institution or economical establishment.

Collecting keys to new flat upon completion of all authorized processes.

Continuing In keeping with HDB's guidelines for resale flats or Construct-to-Buy (BTO) flats.

Allowing Go of Solution:

Forfeiting any service fees paid throughout booking: alternative price, work out rate, etcetera.

Allowing Other people considering getting that exact HDB flat through remaining profits launch/application periods.

It is important for potential purchasers to be aware that failing to exercise their option by not finishing requisite steps in its validity time period might trigger them to lose the choice costs forfeit in its entirety.

Conclusion

The choice to invest in (OTP) is an important document in the whole process of paying for an HDB flat. It offers consumers with unique legal rights, time for final decision-generating, and flexibility before confirming their order. Knowledge the measures involved, vital stipulations, and feasible results when doing exercises or permitting go of an alternative is essential for people taking into consideration HDB ownership.